This article examines the way post-bellum genres of disability, race, and credit-debt shaped the emergence of US slave insurance and life insurance industries. After all, the same period which witnessed the demise of formal enslavement saw the debut of structures that protected the privilege of people whose wealth and power suddenly threatened to come undone: this would include sharecropping and convict leasing. Despite a similar emphasis on institutionalizing credit-debt relations, insurance sometimes appears benign by comparison. Even though insurance agencies assign differential value to human lives, the birth of insurance is frequently seen—along with the triumph of capitalism and democracy—as part of the birth of freedom. In what follows, I explore a discourse on debility that is likewise a discourse on debt—one with enduring resonance for social movement politics.

"In life we are in the midst of death, and a day or an hour may paralyze the hand which feeds the helpless…

… In a country like ours, where with untrammeled energies and eager grasp, we are pressing along the road which leads to fortune and greatness, we sometimes travel too fast, and great commercial convulsions are inevitable consequences, which bring ruin on individuals the most prudent and cautious…Take a person so situated…with the uncertainty of life hanging over him, and how much more cheerfully would he toil on, could he say, come what may my life is insured, and my wife and children are sure of something to save them from want."

"As long as the negro is sound, and worth more than the amount of the insured, self-interest will prompt the owner to preserve the life of the slave; but, if the slave become unsound and there is little prospect of perfect recovery, the underwriters cannot expect fair play—the insurance money is worth more than the slave, and the latter is regarded rather in the light of a superannuated horse."

On August 25, 2011, NBC and other news outlets reported a scheme that US presidential candidate, Rick Perry—then governor of Texas—had concocted in 2003, to take out life insurance policies on retiring public school teachers through the Swiss financial firm UBS (a couple months before the firm would declare that, in part as a result of the global financial crisis, it had faced many, heavy and substantial, losses and nearly six months before UBS would make the news again as one of the corporate entities entrusted with some of presidential candidate Mitt Romney's Swiss accounts as cited in the 2010 tax returns he made public in January of 2012). The rationale behind Perry's indecent proposal? These senior citizens had a high statistical probability to die within the next decade. When they did, the government of Texas could turn a profit.

Michael Moore examines a similar practice in his 2009 documentary, Capitalism: A Love Story, through the devastating revelation that a number of Fortune 500 companies—including Bank of America, Citibank, McDonnell Douglas, Hershey, Nestlé, Wal-Mart, Proctor & Gamble and American Express—have made use of what industry insiders call "corporate-owned life insurance" (COLI) policies, more commonly known as, "dead peasant insurance." When Daniel L. Johnson died of cancer, Moore tells us, Amegy Bank made more than $5 million on policies it had take out in his name that were never shared with his dependents. "There is a reason that it is illegal for me to take out a fire insurance policy on your house," Moore insists, incredulous that any one could provide corporations with incentives to have employees "die in accordance with their policy projections." Yet, as it turns out, there is a precedent for wealthy people to benefit from the death of others.

Historians have reached an apparent consensus about why the US life insurance industry did not take root until the 1840s. They have argued persuasively that, as more and more Americans abandoned rural homesteads for urban employment opportunities, they left behind the community networks that had previously sustained them in times of crisis. These developments, coupled with the declining significance of the church as the primary arbiter of moral judgment regarding commercial matters, led many Americans to find security in emergent forms of investment, like life insurance. Or, so the argument goes. Yet this narrative fails to adequately explain why Americans embraced life insurance at this specific historical juncture: a few years after the formal abolition of slavery in Britain, in the decades which would ultimately come to include secession, war, Reconstruction, and Redemption, in the US. How did these developments shape changing attitudes about the value of a human life? About region, race, mortality and risk? Life insurance began in earnest in Britain in the latter part of the eighteenth century after the emergent field of probability mathematics settled on the life table as a way to chart and quantify human mortality. And while the idea of insuring a human life was not immediately institutionalized in any systematic fashion, life insurance took root in British civil society in the decades to follow. Why, then, did it take many more decades before the industry gained credibility in the US despite widespread campaigns to boost its popularity? In this course of this inquiry, it is crucial that we do not overlook sustained efforts by life insurance firms to create a favorable impression concerning the merits of this new strategy for capitalizing risk.

Amidst these causal factors, it is worth noting that scholarly explanations about the historical emergence of life insurance typically overlook the business of insuring slaves, which had become a robust domain of commercial traffic by the 1830s. This oversight stems from too narrow an analytic framework: slave insurance was property insurance—real estate, more specifically, in places like New Orleans—as "Negros" did not have juridical status as legal "persons" until the formal abolition of slavery in the US in 1865. And yet, in slave insurance policies, human chattel was priced, not according to physical stature (as has often been the assumption); instead, prices were based on the enslaved person's skill set: artisans (like blacksmiths), workers with highly coveted expertise (like coal miners) and those who excelled in especially dangerous industries (like railroads) commanded the highest dividends. This means slave insurance was more like life insurance than historians have been wont to acknowledge. It also means that slave insurance foreshadowed post-bellum genres of corporate insurance, as owners of capital sought to shield themselves against the risks associated with the loss of an individual's capacity for labor.

Because it is intimately connected to our capacity to find relief from illness or injury, since it is bound up in our ability to earn an income and with the fate of our closest kin, insurance—namely, life insurance—has, since the industrial age, helped people to measure the distance from familiar modes of mutual aid. These formal structures of financial assistance continue to provide a language through which people comment on social mobility. "Ice insured. Fuck life insurance," says rapper Rick Ross—who borrowed his stage persona from a notorious narcotics trafficker by the same name—in "Live Fast, Die Young, as he asserts that his jewelry is more valuable, and thus more worthy of securitization, than his own life. 1 Taking my cue from the question of what it means for one person to have a commercial interest in another person's life, this essay uses the under-theorized relationship between slave insurance and life insurance to chart the politics of stratification in the modern age. 2 After all, the same period which witnessed the demise of formal enslavement saw the debut of structures that protected the privilege of people whose wealth and power threatened to come undone: this would include sharecropping and convict leasing. Despite a similar emphasis on institutionalizing credit-debt relations, insurance appears benign by comparison. Even though insurance agencies assign differential value to human lives, the birth of insurance is frequently seen, along with the triumph of capitalism and democracy, as part of the birth of freedom. In what follows, I explore how this paradox defined the dialectical emergence of industries for slave insurance and life insurance—and, by extension, categories of social belonging and forms of economic and political participation—in the antebellum and postbellum US.

Of sound mind and body

In a May 1847 issue of the eminent antebellum periodical The Commercial Review of the South and West (also known as De Bow's Review) a contributing writer who simply identifies himself as "a citizen of Mississippi," shares with his fellow "southern planters" the benefit of his inherited and cultivated wisdom concerning the "health of negroes" in an editorial appropriately entitled, "The Negro" (hereafter N): 3

… I have been conversant with the health of negroes and the treatment of them in many localities and by many masters. I have practiced medicine on large and small estates, and have attempted different modes of management, observing closely and to profit [sic] the good or bad of systems of others (N, 419).

That our planter has a history of "practicing medicine" on slave plantations does not mean he is a qualified medical professional, otherwise he likely would have established his credentials. Instead, "practicing medicine" must be viewed alongside other "modes of management," as in his ethnographic methods, or strategies for "observing closely" those techniques that generate "profit" within his own plantations and in the "systems of others," both peers and forebears, "I am a southerner and my ancestors before me were southerners. I am a slaveholder and I have been so for a quarter century" (N, 419).

This Mississippi citizen is concerned to affirm the crucial role of labor management—in his terms, the central emphasis a planter must place on "the value of negro property"—in order to build an enduring franchise:

There are planters even at this date who regard their sole interest to consist in large crops, leaving out of view altogether the value of negro property and its possible deterioration by unskillful usage, like any other property. To say nothing about morality, this is a great pecuniary evil…(N, 419)

Here, it is not slavery that is evil but being careless in the service of one's "negro property," being prone to excess, whether that means being wasteful in the way of resources or especially cruel. Being deliberate, thoughtful, moderate is what distinguishes the forensic profile 4 of the planter (and his demographic) from the slave (and those of his ilk):

Negroes are thriftless, thoughtless people, and have to be restricted in many points essential to their constitutions and health. Left to themselves they will over eat…walk half the night, sleep on the ground, out of doors, anywhere (N, 420).

Thus the unrestricted slave ceases to become an asset and becomes a liability even if it's not the relation between assets and liabilities but the very notion that "value" can adequately be assessed this way, which defines capitalism as a pervasive social logic. Since the "Negro" is "thoughtless," it is impossible to account for him outside the purview of modern capital. Neither his intellect nor his "constitution" 5 bears any resemblance to white, male, southern planters—to the "citizens" who govern southern polities.

In a brief moment of reflexivity, our Mississippi planter confesses his own prior frustration in presuming that he "could tell beforehand when negroes would be sickly, and could point to those who would be affected," though he remains convinced that the essential task of the planter is "to prevent disease and prolong the useful laboring period of the negro's life." In this complicated calculus of value extraction and "medicine," the planter sees the latter technology as the key to success in the former domain, stressing that he would rather "lose time than suffer the slave's exposure to the elements," in a phrase that belies the extent to which slaves were not simply beasts of burden or laborers but bundles of capital (where capital = value extracted from reified time). Despite the language of "property" this citizen prefers it's worth noting that by the time his editorial was published, a slave was more likely to be hired out by a planter to another plantation owner than s/he was to be sold. In certain parts of the United States (in New Orleans, especially) slaves were routinely mortgaged. 6 And, for more than a decade, slave insurance had been a profitable industry.

In this same issue of the Commercial Review, the famed scientist Josiah C. Nott—best known for his 1854 publication,Types of Mankind: Or, Ethnological Researches: Based Upon the Ancient Monuments, Paintings, Sculptures, and Crania of Races, and Upon Their Natural, Geographical, Philological and Biblical History, which he co-wrote with the American Egyptologist, George R. Gliddon, and which featured illustrations by the American physician and craniometrist Samuel George Morton with additional contributions by the paleontologist Louis Agassiz 7 —contributed to an ongoing conversation the journal had been having about Marine and Fire Insurance. But Nott is concerned to set "forth the advantages of life insurance."

"[N]othing," Nott insists, "is more uncertain than human existence" (LIS, 358). Yet if it is more prone to peril, life insurance likewise possesses unprecedented promise to generate "prosperity" for "individuals and nations" who are "prudent" enough to capitalize on this new security, both in the sense of "safety" and with reference to this new mode of finance and investment (LIS, 358). 8 Nott uses the term "life insurance" to explore a broad range of valuation, including the prospect of insuring free or "colored" African Americans. He also confesses, in passing, to having assessed the value of slaves in his capacity as a medical examiner. It is a telling comparison in a discussion about life insurance, because slave insurance has never been systematically analyzed alongside life insurance in the historical scholarship. Often the link between slavery and insurance centers on marine insurance, or slaves-as-cargo. 9 Elsewhere, the scholarship notes that life insurance companies raised the question of whether to offer policies to free and enslaved African Americans, but generally omits them from discussion after insurance firms made the decision not to take black clients. 10 Even when historians of life insurance discuss slave insurance, they restrict it to a separate category of valuation without considering the theoretical payoff that might derive from complicating the boundary between "negro property" and "legal persons," especially since the insured value of a slave was not based on physical stature, nor even on the capacity to breed (which became especially significant in the US between the abolition of the slave trade in 1808 and the abolition of slavery in the 1860s).

As I have mentioned above, slaves insured for the highest amounts were artisans with privileged skill sets, like blacksmiths, or those who worked in especially dangerous industries, like mining or on steamboats, making slave insurance an early version of corporate or industrial insurance, if not quite workmen's compensation. 11 These dynamics were acute in the commercial history of New Orleans, which became the nation's leading slave market in the decades following the Louisiana Purchase of 1804. In shipping slaves to the Lower South, planters usually sent them by steamboat down and around the East Coast from Chesapeake Bay port cities like Baltimore, or down the Mississippi River from Midwestern cities in Ohio, Indiana or Illinois. And, to mitigate the potential hazards associated with transport—the potential of a ship capsizing or being overtaken by privateers and pirates—planters routinely took out insurance policies on their slaves.

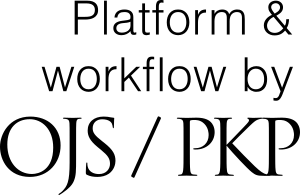

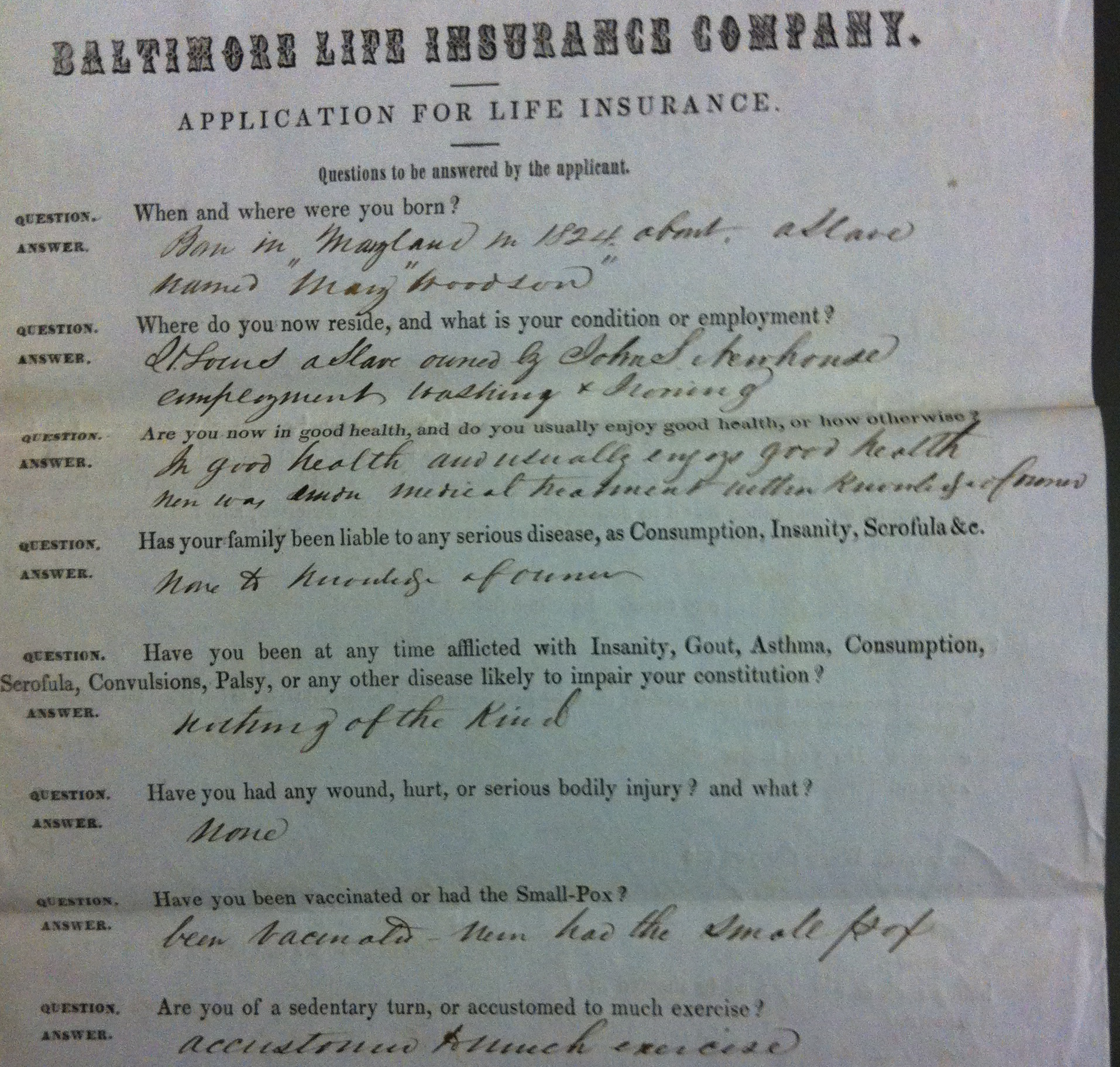

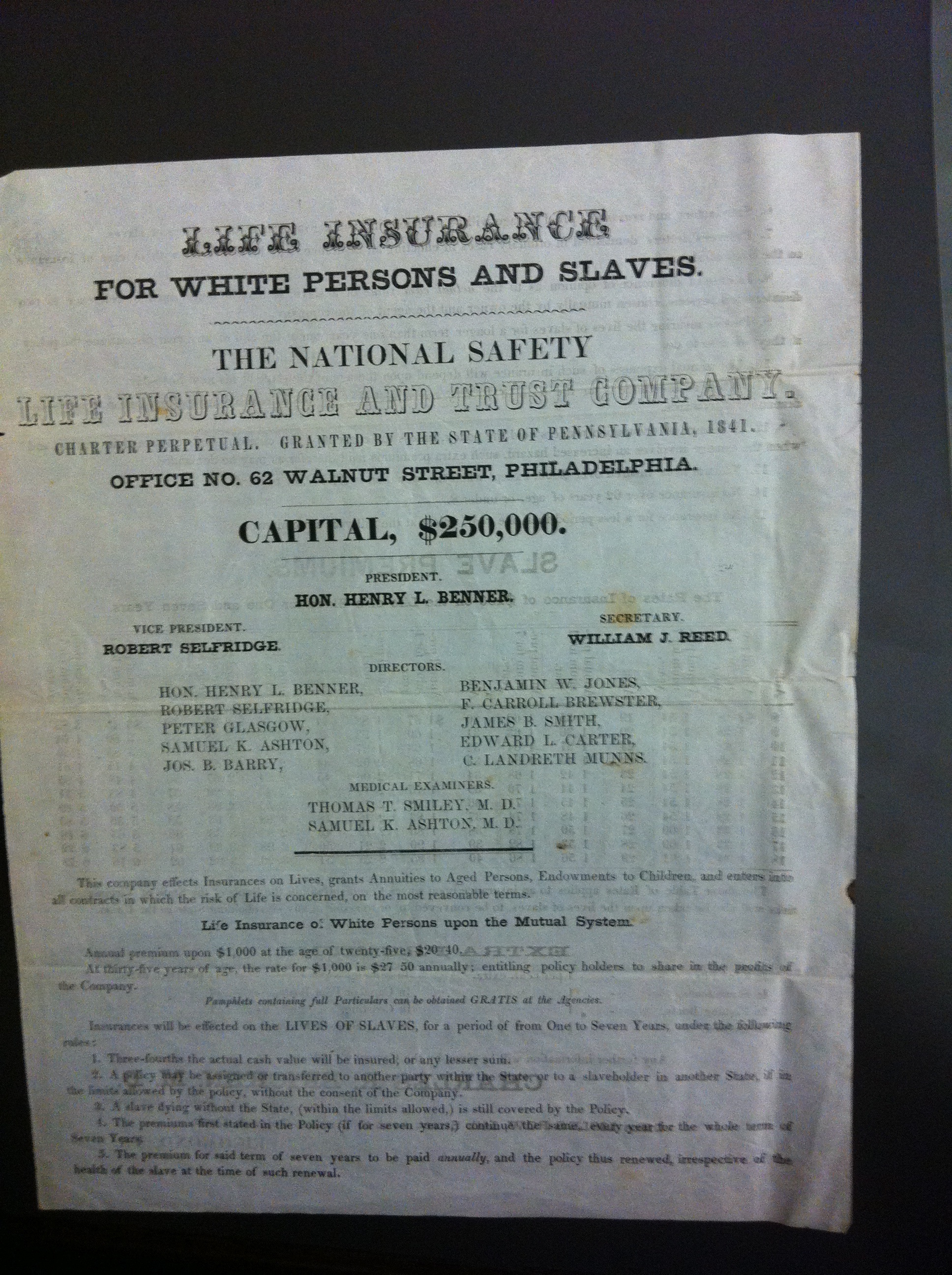

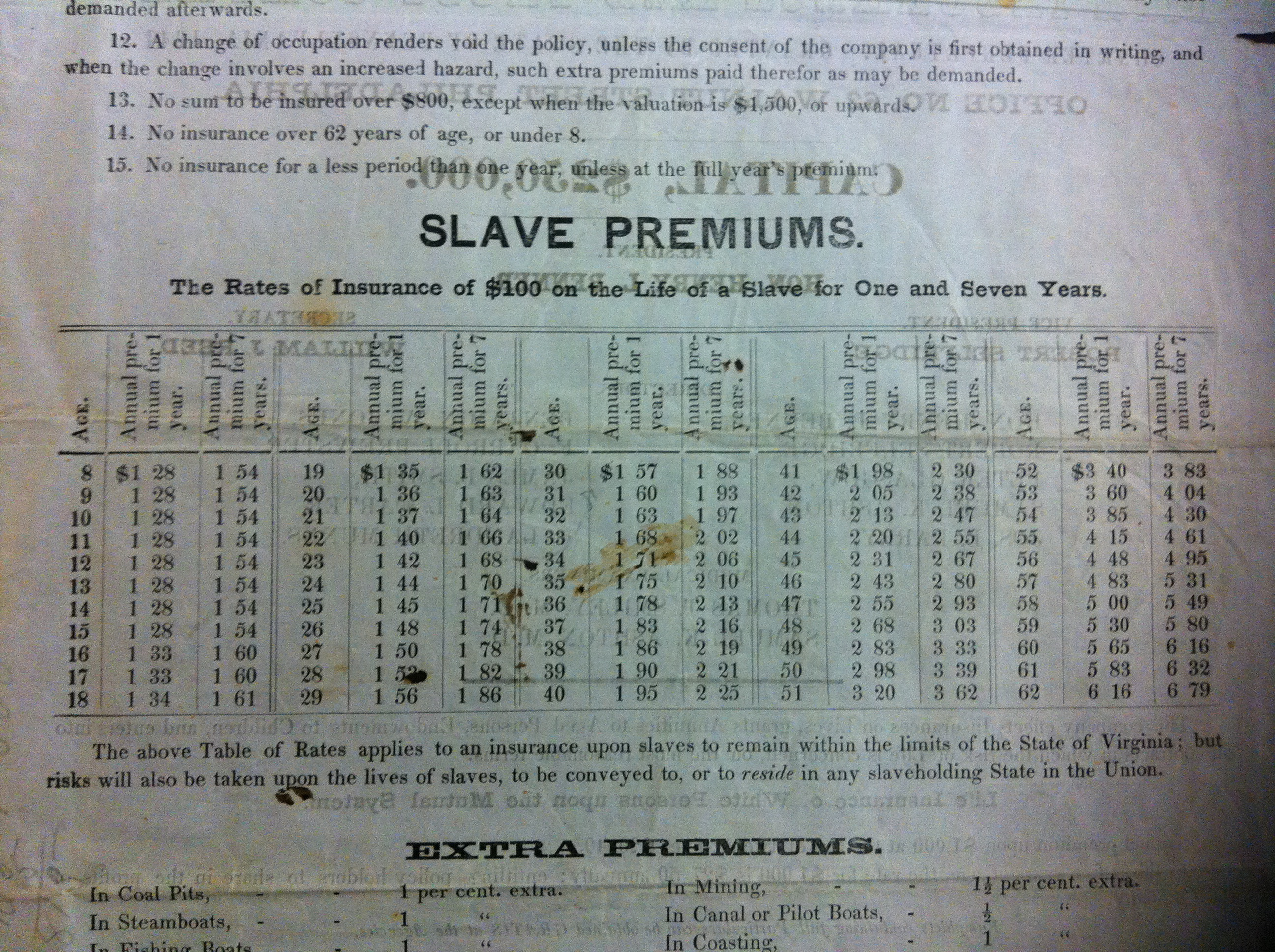

Comparing slave insurance to life insurance underscores the tension between concrete and abstract views of what it meant to be a human being in the nineteenth century US. This unsteady dialectic likewise underscores the role that risk plays as a historically produced and institutionally regimented genre of ad hoc classification 12 that masquerades as universal. In applications dated to 1841, the National Safety Life Insurance and Trust company of Pennsylvania promoted services for "white persons and slaves" despite the juridical differences that obtained between these two groups as "persons" protected under the law and as "property," respectively. 13 National Loan and Life Insurance company of London offered insurance as a "method by which slave owners may be protected from loss," 14 but did not apparently categorize it as a separate entity called, "slave insurance." Even when these firms specified that the value of policies for "whites" would be based upon different modes of valuation, it's clear that these systems of calculation overlap and intersect. In fact, policies like those the Baltimore Life Insurance company used, which spelled out the age range for which whites would be covered—as in, "No insurance over 62 years of age or under 8" 15 —provoke comparisons with slave life expectancies since planters would often use the same applications to purchase insurance for themselves and their property. Meanwhile, mortality rates were so high for planters in 18th century Jamaica that insurance companies would not even permit them to take out policies on their own lives even when it was easy to insure their slave cargo. 16

In November 1847, Nott published an article entitled, "Statistics of Southern Slave Populations" (hereafter SSSP) 17 in The Commercial Review noting that six months prior he had made "reference only to the white population," but would now—"in compliance" with a "request" from the editor—deliver a "few remarks on the value of life among the colored population, which" he notes, "is becoming a very important subject for consideration. Nott found the dearth of information on the "statistics of blacks" to be "positively disreputable," and worried that insufficient information did not seem to prevent some "insurance companies" from going into the slave insurance business "pell-mell, without knowing anything of the probabilities" their economic projections would necessarily involve (SSSP, 275). Most life insurance companies decided that slaves presented too great a challenge as a risk-factor and avoided offering slave insurance altogether, leaving a few a firms to dominate the industry so that, after starting with a policy for a slave named Jacob in 1831 the Baltimore Life Insurance Company would go on to corner the market on slave insurance. 18

In his November 1847 article, Nott unearths a tension between concrete and abstract notions of embodied risk that he must resolve if he is to convince his audience about the virtues of insurance and prevent North Atlantic firms from continuing to see the South as, somehow, inherently debilitated. Even as he praises insurance for helping to secure commercial futures, Nott must grapple with the fact that Southerners, like himself, faced higher rates based on the notion that men of this region have weaker vital statistics. To combat this idea, he cites flaws in the actuarial paradigm of medical statistics on which the industry relies: "A company may work admirably for a few years, and eventually wind up disastrously. Several hundred, or several thousand badly selected lives may go on smoothly for several years," but "if [these policies are] badly selected … a heavy loss must follow (LIS, 360)." This is precisely why Nott would be such a staunch advocate of investing in slaves—it appeared, to him, to be more sure.

Insurance firms would use the same logic to deny coverage to African Americans once slavery was legally abolished, that the lives of free blacks were somehow more difficult to assess than slaves. Meanwhile, Nott tried to distinguish slaves and "colored people" from the Deep South from those of the "Atlantic states" which he viewed as physically and morally inferior. Citing a pedigree which included French and Spanish colonial influences, Nott saw Negroes from the Deep South as somehow more refined (SSSP, 284), which he translated into a more reliable work ethic and fidelity to planters. This characterization perhaps stemmed in part from a broader concern to counteract a prevailing North-South dichotomy of civilization, which surfaced in tandem with the rise of northern interest in breaking with plantation slavery in favor of new strategies for investment (even if regional economies remained tethered in ways that evaded popular commentary).

Nott's critique of the burgeoning industry for life insurance in the US derived from his sense that firms had essentially imported a North Atlantic view of the industry that read the South as a region apart. In his words:

"All Life Insurance Companies of the United States are north of the Potomac, as are nearly all the writers on vital statistics, and we are satisfied that a want of local information and personal observation have led them into many grave errors respecting our condition at the south…(LIS, 362),"

By the last few decades of the nineteenth century, with the consolidation of the US nation-state in the aftermath of the Civil War, insurance firms would finally be persuaded not to charge white southerners higher premiums for life insurance. 19 The industry for slave insurance, meanwhile, evaporated once African Americans had been legally freed from bondage. And yet insurance companies would now charge African Americans higher rates for life insurance than their white counterparts, basing premiums on the cultivated expertise of medical examiners like Nott who continued to use vital statistics as their guide for life expectancies without acknowledging that black life expectancies were half that of white Americans by the time that slavery was abolished. Even black life insurance companies, as firms competing within the same industry, saddled black clients with differential rates of coverage based on the same ostensibly objective medical assessments, 20 confirming the worst fears of some African American intellectuals and activists. The renowned African American sociologist, W.E.B. Dubois worried that black life insurance firms would mean the official demise of the mutual aid societies that African Americans had formed during the context of enslavement in the US to pool economic resources and to ensure the proper burial of deceased friends and relatives in the event of fatal accidents, 21 a pervasive tradition in which groups like New Orleans Social Aid & Pleasure Clubs see themselves as being self-consciously engaged, even today. In the words of Sylvester Francis, amateur archivist of the New Orleans Backstreet Cultural Museum, these organizations began during the 1830s and 1840s "as an early form of life insurance." 22

In 1898, Dubois—then a professor at Atlanta University—edited a report based on the proceedings of the "Third Conference for the Study of Negro Problems," which his institution had hosted on May 25th and May 26th of that year. This publication capped a three-year, three-part, research investigation: an inquiry concerning "the Mortality of Negroes in Cities" in 1896, "another into the General Social and Physical Condition of 5,000 Negroes living in selected parts of certain Southern cities" in 1897 and, now, an examination of "efforts Negros" had been "making to better their social condition." It is in this context that Dubois confesses a longstanding fear that the birth of black life insurance firms would spell the official demise of the mutual aid societies formed as indigenous mechanisms of security during the context of enslavement and would also lead newly emancipated African Americans to be exploited by insurance firms, as he argues in his 1898 report, "Negroes should be emphatically warned against unstable insurance societies conducted by irresponsible parties, and offering insurance for small weekly payments, which really amount to exorbitant rates."

And yet the plight of "the Negro" was bound up with that of other marginal constituencies, as evidenced by the statutes many US states passed between the second half of the nineteenth century and the first part of the twentieth century to regulate their movement. "Unsightly Beggar Ordinances" or "Ugly Laws," as this legislation has since been called, lumped a range of social actors together as a menace to US civil society: sex workers, the homeless, vagrants, newly emancipated slaves and unemployed persons, many of whom were disabled in emergent industries in the decades before employers were legally required to offer worker's compensation.

An 1879 New Orleans statute attests to the indeterminacy of the "unsightly beggar ordinance", as it sought to "create, define and punish each of the offenses of being an idle and disorderly person and of being a rouge and a vagabond: and to provide for the summary trial and punishment of offenders against the provisions of this ordinance and of officers and members of the police force for failing and neglecting the duties imposed upon them by this ordinance." 23 Of course, New Orleans is an appropriate place from which to chart the contradictions of a post-bellum nation in flux. Homer Plessy is, of course, best known for his role as the lead plaintiff in a legal case which led to the juridical entrenchment of Jim Crow segregation, when a court decided—much to the surprise of the activist coalition known as the Comité de Citoyens who had staged the case as a challenge to the segregation laws then being passed with alarming frequency—that it was permissible to bar African Americans from railway cars as long as they were provided with "separate" and "equal" accommodations. That ruling would remain in place until Brown v. Board of Education of Topeka, Kansas some 58 years later. Yet, scholars have generally overlooked the fact that Homer Plessy worked for People's Life Insurance, 24 later purchased by Atlanta Life Insurance, one of the most powerful black corporations in US history, a franchise largely responsible for many of the civic and educational opportunities made available to African Americans during the era of legalized segregation, and beyond. 25

Thus, it appears the formation of the modern nation-state was in part concerned not simply with establishing a monopoly over violence, or labor, but also social mobility. This is evident in post-bellum discourses on labor as much as in modern technologies of sovereign mobility, like the passport. 26 In this context, social actors who could not secure access to emergent forms of social and political legitimacy were rendered inadequate through political practices that collapsed a broad range of distinctions into a category of people discounted from the project of modern progress. Debilitated, dependent subjects might be sex workers, newly emancipated "Negroes," or homeless persons and vagrants. Meanwhile female vagrancy was closely associated with prostitution, as the notion of women who were free to earn wages and whose behavior exceeded the grasp of law enforcement authorities provoked social anxieties that illustrated the economic and moral contradictions latent within new economic and political transformations. 27 The way that insurance underwriters ultimately helped to institutionalize a discourse on debilitated African Americans thought to possess weaker vital statistics and mental acuity, in objective terms, has to be read as part of a broader economic and political landscape.

The world of security, risk, race, and disability would soon become even more complicated with the rise of industrial insurance, which helped white workers to stave off the potentially debilitating consequences of proliferating mills and factories and other technologies associated with economic development. 28 By the New Deal era, these developments had cohered into new ideas about the relationship between economic disenfranchisement, disability and displacement. The labor industry witnessed the formal constitution of worker's compensation. In retrospect, this period can also be said to mark the beginning of a disability rights movement, which sought to address the contradictions and limitations of these initiatives. New Deal programs provided relief to people who were unable to work due to physical debilities. Yet, these capitalized initiatives created new forms of stigma that often translated into acts of discrimination. For this reason, groups like the League of the Physically Handicapped and, later, National Federation of the Blind, worked to create greater public awareness about the range of abilities, and unique relationships to the world, different Americans possess, articulating how policies and infrastructure could help to foster "freedom of movement." 29

This social justice project pushed beyond "charity" as a mode of social reform. By the 1970s, the concerted efforts of activists and intellectuals had coalesced into a full-fledged movement, which could be seen to culminate with the passage of the American with Disabilities Act in 1990. And yet, as many disability rights scholars and activists have noted, the ADA has a number of limitations, as juridical methods for evaluating and distributing coverage remain spotty and inconsistent. Perhaps even more disconcerting, "disability" coverage is the only civil right that legislates recourse to a medicalized definition for inclusion. As the foregoing suggests, scientific evaluations are always historically conditioned, thus there will inevitably be systematic biases built into the distribution of services which can only be remedied by more careful attention to the categories of political belonging and the structures that shape emergent discourses of human and civil rights.

The twentieth-century welfare state helped produce a vibrant, if racially homogenous, American middle class. Along these lines, it is worth noting that African Americans were explicitly denied access to the same New Deal reforms that benefitted European Americans and European immigrants. 30 The bureaucratic category of disability had emerged as a way to locate citizens who could now claim government assistance for the debilitating circumstances they were forced to suffer. The welfare state sought to remedy economic and physical debility through a broad investment in providing new strategies to secure the American worker. Meanwhile, as part of a backlash against the period of Reconstruction which followed Emancipation and in which African Americans had finally started to receive the civic entitlements they had struggled in pursuit of for so long, "the Negro" began to surface in popular discourses as a subject whose moral baggage made him or her unfit for first-class citizenship. Thus while the white, disabled citizen and the Negro were both seen as somehow dependent, members of the former category were thought to be deserving of charity and government assistance, while those in the latter demographic were held to be responsible for their own incapacity to achieve economic and political success and to secure moral standing.

So when New Deal-era notions about the government's debt to its citizens and the citizens' debt to society led to changes not simply in the marketplace but in law enforcement, some groups managed to benefit more than others. Whereas white men made up the overwhelming majority of the US prison population in the 1920s, African American men would, in a matter of decades, be slotted into penal institutions to take the place of formerly marginal populations who used Depression-Era legislation to gain a foothold in the interwar economy. 31 In the process, social science often unwittingly provided the ideological impetus for structural racism and for deliberate acts of racial violence, as the value of a human life was shaped by prevailing ideas about the innate characteristics and, thus qualifications, of specific demographics.

These developments had been several decades in the making. Less than a generation after abolition, with the emergence of new methods for collecting and analyzing statistical data, lingering suspicions about race and criminality became more deeply entrenched in academic circles. Once the 1890 census was published, northern and southern social scientists alike began to use statistics that showcased the disproportionate incarceration rates of African Americans as "evidence" they constituted a "distinct and dangerous criminal population." 32 The decades following the Civil War had triggered a massive backlash against efforts to extend civil freedoms to African Americans, palpable in the spread of ideas linked to racial inferiority even among liberal scholars concerned to help improve the plight of people who had only recently escaped from bondage. Yet the premise of objectivity made it difficult to detect just how much historic notions of mental and moral inferiority had been successfully institutionalized and re-branded using what appeared to be a more sophisticated scientific toolkit.

At this juncture white criminality faded from view while blackness came to be seen as a causal factor in criminal behavior. 33 In one of the first criminology textbooks, Charles Richmond Henderson, of the University of Chicago, assured readers that crime initiated by recent European immigrants was "not so great [a problem] as statistics carelessly interpreted might [be said to] prove." By contrast, he insisted that the "primary factor[s]" which explained the disproportionate arrest and conviction rates of "Negro[s]" were "racial inheritance, physical and mental inferiority, barbarian and slave culture" as this demographic had been unprepared for the "sudden and unprepared change in economic and political status" that occurred with emancipation. 34 Thus, some of the same scholars who remained convinced that it would be some time before African Americans who could be expected to achieve intellectual and moral parity with European Americans—and who cited new statistical data to demonstrate the perceived limits of social policy to address the "Negro problem"—used emergent statistical methods to condemn and eradicate biases against recent European immigrants.

Famed journalist and anti-lynching activist Ida B. Wells sought to demonstrate that, in fact, most of the turn-of-the century scholarship had the causal arrows reversed. It was by no means the case that African Americans exhibited moral failings on a grander scale than European Americans and were thus deserving of greater sanction at the hands of violent mobs that often received amnesty from law enforcement officials, producing mob violence as a de facto element of the criminal justice system. 35 Instead, the abolition of slavery had triggered a massive influx of African Americans into the labor force and whites panicked, and then sought to alleviate their frustrations by participating in, and trying to justify, racial terror against African Americans.

Subsequently, workers and owners of capital sought to rationalize their behavior by insisting that African Americans were inherently criminal and thus needed to be policed, surveilled and killed to alleviate the threat posed by their presence as indices of "black criminality" triumphed over other forms of scientific evidence—brain size, patterns of speech, disease, body odor and intelligence quotients—which had historically been used to assert "black inferiority," or debility. These developments were institutionalized through the use of statistics that drew together southern racist and northern liberal discourses on black criminality from the 1890s onward. 36 In 1884, Harvard paleontologist Nathaniel Southgate Shale stressed that, "There can be no doubt that, judged by the light of experience, [Negroes] are a danger to America greater and more insuperable than any of those that menace the other great civilized states of the world," as he read political economy of exploitation that characterized plantation societies backwards into a static argument about some alleged essence of the Negro which made it difficult, if not impossible, for members of this species to attain a "civilized" standard of living. Meanwhile, one of Shale's student at Harvard, W.E.B. Dubois himself, saw this kind of argument as part of a "nineteenth century" project to substitute moralistic apologies for the coercive treatment of African Americans in place of historical and sociological inquiry. Dubois would go on to demonstrate that it was the repression of newly emancipated African Americans, and new laws of policing and surveillance which used the idea of vagrancy to criminalize people who had not yet managed to establish stable employment or secure housing, which contributed to the errant perception that African Americans were a criminal constituency.

Though he was sometimes guilty of his own dubious excursions into bourgeois morality as a shield for more engaged historical and sociological analysis, Dubois was careful to marshal statistical, ethnographic and historical evidence in the service of critiquing the alleged innate inferiority of African Americans. At times, his scholarship was concerned with showing that a good many African Americans managed to live "normal" lives, both in terms of the prudent economic management of their households, yet also through attending to moral sanctity. In this line of argument, equality was pursued through careful attention to a politics of respectability. At the same time it is worth noting how Dubois frames the predicament of African Americans through discourse on debility even if it remains undertheorized in his account.

Dubois famously argued in his 1903 Souls of Black Folk that the widespread lynching of Negros led African Americans—who were consistently being told they didn't belong in the US but who knew no other land—to experience "double consciousness," leaving them "trapped within the veil": locked into a different tier of citizenship even though it "blessed" them with the "gift of second sight." Disability studies scholars, as well as persons with different sorts of abilities and vulnerabilities, continue to debate the status of the claim that debility yields heightened capacity. 37 And, inasmuch as being debilitated necessarily involves personal experiences that are impossible for others to appreciate, it's not clear this debate can ever be resolved. Yet, precisely because it is impossible to clarify just how the predicament of enslavement might be conceived as a genre of debility, the pairing of human bondage with disability remains a productive site for further social and historical inquiry, especially since Dubois emphasizes the dialectical construction of the individual and society. Dubois' veil references a structural location as much as an individual obstacle. Note that Karl Marx used the same concept to explore the dialectical tension between exploited workers in Britain and in the British plantation societies: "The veiled slavery of wage-workers in Europe needed, for its pedestal, slavery pure and simple," he wrote in Capital, volume I. 38 Might we combine this insight with Dubois' subtle articulation of economic and political debility in the post-emancipation US? Might this German-schooled sociologist—who, we know, was fond of dialectics—have discerned that, to paraphrase Marx, the veiled exclusion of the disabled needed, for its pedestal, exclusion pure and simple? Here, it is perhaps crucial to recall that resemblance lies at the basis of all dialectics. 39

Debilitated, if emboldened by their marginal position, African Americans struggled to secure the pensions and entitlements white (and, especially European immigrant) wage laborers managed to secure during the last few decades of the nineteenth century and the first few decades of the twentieth. 40 Thus Du Bois was explicitly concerned to hitch the predicament of enslavement to the history of labor in the US, as he was careful to chronicle moments when enslaved actors abandoned their work regimens, producing general strikes41 (though earlier examples, like those which took place during the 1811 uprising of slaves in New Orleans, the largest ever on US soil, are still coming to light). 42 And, in fact, connecting the institution of enslavement to modern wage labor lends insights to the institutional intricacies of each social matrix.

This articulation between vagrancy laws and Jim Crow statutes, between disability and civil rights, perhaps sheds some light on the conceptual and pragmatic articulation between slavery and modern capital which surfaces in the example of corporate-owned life insurance, discussed above—which, despite the public outcry that has accompanied recent reportage—is not so much a new development as a reminder of a subterranean trajectory that traffics in embodied labor and in the value to be extracted from a human being as a capital asset. Corporate-owned life insurance relies for its efficacy on the same logic that provided an initial shield for corporations when they first emerged in 1830s Britain: as a "security," even if COLI offers a rather different set of possibilities, and has a different structure, than "whole-term life insurance"—and even if the covert method in which these opportunities are made available to corporations disrupts the premise of individual freedom upon which capitalism rests. Thus COLI is a reminder of opportunities that exist for the individualized collective social actor that is the corporation which do not exist for individual citizens. As Josiah C. Nott noted in his May 1847 article, "There must be an interest in the life of the insured, as of a creditor," in language that resonates with the language of an 1831 Baltimore Life Insurance pamphlet, "No person can insure the life of another, unless he has an interest in such life." At the same time, COLI explicitly draws upon nineteenth century legislation that emerged from the shared conceptual universe of slavery and wage labor. The author of a 2008 "Layman's Guide to Corporate Life Insurance," cites an 1881 Supreme Court ruling to specify the economic rationale of COLI: Warnock v. Davis … defines insurable interest as follows: "(i) In the case of individuals related closely by blood or by law, a substantial interest engendered by love and affection; and (ii) In the case of other persons, a lawful and substantial economic interest in having the life, health or bodily safety of the individual insured continue, as distinguished from an interest that would arise only by, or would be enhanced in value by, the death, disability or injury of the individual insured." 43 Meanwhile, Daniel Johnson's multi-million dollar death would seem to undermine the legal rationale that a COLI policy restricts an employee from being "enhanced in value by, death, disability or injury."

That one can leverage the risk-factor of an employee—or, for that matter, an aging public school teacher—as a way to generate wealth offers a more complicated portrait of the extraction of surplus value than we are used to seeing, even if it's not something that we can afford to overlook any longer. For one implication of this research is that even people who do not see themselves as the descendants of Africa slaves are implicated in forms of valuation forged during the age of legalized enslavement. From this vantage, social movement politics are steeped in political aspirations both abstract and immediate. And the short-lived US experiment with "separate-but-equal" facilities is a reminder that the question of access—the idea of full participation—is neither merely a matter of legal enfranchisement nor a question of how someone navigates the built environment, for it is not always easy to discern where one kind of barrier ends and another begins.

Endnotes

-

Rick Ross, "Life Fast, Die Young," Perajok and Kanye West present G.O.O.D. Ass Mixtape, 2010.

Return to Text -

Thus, in what follows, I am less interested in "comparing" different movements than in exploring what each has to offer the other, and how they might be combined to address other forms of social stratification. For a thoughtful juxtaposition of different social justice projects, consider Tom Mertes, ed., A Movement of Movements: Is Another World Really Possible? (London: Verso, 2004). For a more explicit effort to theorize diverse genres of social stratification, see Nicholas de Genova and Nathalie Puetz, The Deportation Regime: Sovereignty, Space and the Freedom of Movement (Durham: Duke University Press, 2010).

Return to Text -

A Citizen of Mississippi, "The Negro," The Commercial Review of the South and the West 3 (May 1847): 419.

Return to Text -

Michael Ralph, Forensics of Capital: Risk and Liability, Citizenship and Sovereignty, in Senegal (Forthcoming).

Return to Text -

David T. Mitchell and Sharon L. Snyder, "The Eugenic Atlantic: Race, Disability and the Making of an International Eugenics Science, 1800-1945," Disability and Society 7 (2003): 843-864. George Stocking, Race, Culture, and Evolution: Essays in the History of Anthropology (Chicago: University of Chicago Press, 1982).

Return to Text -

On slave hiring, see Jonathan Martin, Divided Mastery: Slave Hiring in the American South (Cambridge: Harvard University Press, 2004). On slave mortgages, see Bonnie Martin, "Slavery's Invisible Engine: Mortgaging Human Property," Journal of Southern History (November 2010): 817-866.

Return to Text -

Types of Mankind: Or, Ethnological Researches: Based Upon the Ancient Monuments, Paintings, Sculptures, and Crania of Races, and Upon Their Natural, Geographical, Philological and Biblical History, Illustrated by Selections from the Inedited Papers of Samuel George Morton and by Additional Contributions from L. Agassiz, W. Usher, and H.S. Patterson. (1854)

Return to Text -

Josiah C. Nott, "Life Insurance at the South," The Commercial Review of the South and West 3 (May 1847): 358.

Return to Text -

Jonathan Levy, "The Ways of Providence: Capitalism, Risk and Freedom in America, 1841-1935," PhD dissertation, University of Chicago, 2008.

Return to Text -

Dan Bouk, "The Science of Difference: Developing Tools for Discrimination in the American Life Insurance Industry, 1830-1930," PhD dissertation, Princeton University, 2009.

Return to Text -

Sharon Ann Murphy, Investing in Life: Insurance in Antebellum America, (Baltimore: Johns Hopkins University Press, 2010). See also Murphy, "Securing Human Property, 615-652, and "Security in an Uncertain World: Life Insurance and the Emergence of Modern America" (PhD dissertation, University of Virginia, 2005), by the same author.

Return to Text -

Geeta Patel, "Risky Subjects: Insurance, Sexuality, and Capital," Social Text 4 (Winter 2006): 25-65. See also Caitlin Zaloom, "The Productive Life of Risk," Cultural Anthropology (August 2004): 365-391 and Levy, "Providence," 17-41.

Return to Text -

National Safety Life Insurance and Trust application, 1841, Baltimore Life Insurance Company archives, Maryland Historical Society.

Return to Text -

National Loan and Life Insurance Assurance Company of London circular, 1852, Baltimore Life Insurance Company archives, Maryland Historical Society.

Return to Text -

Figure 4: List of terms and rates, Baltimore Life Insurance Company archives, Maryland Historical Society.

Return to Text -

Vincent Brown, The Reaper's Garden: Death and Power in the World of Atlantic Slavery (Cambridge: Harvard University Press, 2010), 201.

Return to Text -

Josiah C. Nott, "Statistics of Southern Slave Populations," The Commercial Review of the South and West 3 (November 1847): 275-291.

Return to Text -

Sharon Ann Murphy, "Securing Human Property: Slave Insurance, Life Insurance and Industrialization in the Upper South," Journal of the Early Republic 4 (Winter 2005): 620.

Return to Text -

Dan Bouk, "The Science of Difference: Developing Tools for Discrimination in the American Life Insurance Industry, 1830-1930," PhD dissertation, Princeton University, 2009.

Return to Text -

Walter B. Weare, Black Life Insurance in the New South: A Social History of the North Carolina Mutual Life Insurance Company (Durham: Duke University Press, 1993); Alexa B. Henderson, Atlanta Life Insurance Company: Guardian of Black Economic Dignity (Tuscaloosa: University of Alabama Press, 1990).

Return to Text -

W.E.B. Du Bois, "Some Efforts of American Negroes for their Own Social Betterment," Report of an investigation under the direction of Atlanta University, together with the proceedings of the Third Conference for the Study of Negro Problems, 25th -26th May, 1898.

Return to Text -

Interview with Sylvester Francis, Backstreet Cultural Museum, New Orleans, 20 May 2010.

Return to Text -

Susan M. Schweik, The Ugly Laws: Disability in Public (New York: New York University Press, 2009), 32.

Return to Text -

Keith W. Medley, We as Freemen: Plessy v. Ferguson (Gretna: Pelican, 2003), 214.

Return to Text -

Interview, archivist, Atlanta Life Insurance collection, Herndon Home, June 2010.

Return to Text -

John Torpey, Invention of the Passport: Surveillance, Citizenship and the State (Cambridge: Cambridge University Press, 2000).

Return to Text -

Amy Dru Stanley, From Bondage to Contract: Wage Labor, Marriage and the Market in the Age of Emancipation (Cambridge: Cambridge University Press, 1998). Cf. Audre Lorde, "Age, Race, Class and Sex: Women Redefining Difference," Sister Outsider (Freedom, CA: Crossing Press, 1984), 114-123; Judith Butler, Bodies that Matter: On the Discursive Limits of "Sex" (New York: Routledge, 1993); Robert McRuer and Abby Wilkerson, eds. "Desiring Disability: Queer Theory Meets Disability Studies," Special issue of GLQ: A Journal of Lesbian and Gay Studies 1-2 (2003).

Return to Text -

John Fabian Witt, The Accidental Republic: Crippled Workingmen, Destitute Widows, and the Remaking of American Law (Cambridge: Harvard University Press, 2004).

Return to Text -

Samuel R. Bagenstos, Law and the Contradictions of the Disability Rights Movement (New Haven: Yale University Press, 2009), 12-14.

Return to Text -

Ira Katznelson, When Affirmative Action Was White: An Untold History of Racial Inequality in Twentieth-Century America (New York: W.W. Norton & Company, 2005), 17-23.

Return to Text -

Khalil Gibran Muhammad, "Where Did All the White Criminals Go?: Reconfiguring Race and Crime on the Road to Mass Incarceration," Souls 1 (January 2011): 72-90.

Return to Text -

Khalil Gibran Muhammad, The Condemnation of Blackness: Race, Crime and the Making of Modern Urban America (Cambridge: Harvard University Press, 2010), 3.

Return to Text -

Khalil Gibran Muhammad, The Condemnation of Blackness: Race, Crime and the Making of Modern Urban America (Cambridge: Harvard University Press, 2010), 5.

Return to Text -

Charles Richmond Henderson, An Introduction to the Study of the Dependent, Defective and Delinquent Classes (Boston: Heath & Company, 1901), 246-247.

Return to Text -

Megan Francis, "The Battle for the Hearts and Minds of America," Souls 1(January 2011): 46-71.

Return to Text -

Ida B. Wells, Mob Violence in New Orleans (xx: xx), xx. Khalil Gibran Muhammad, The Condemnation of Blackness: Race, Crime and the Making of Modern Urban America (Cambridge: Harvard University Press, 2010), 2-3.

Return to Text -

On the "supercrip," see Joseph Schapiro, "No Pity: People with Disabilities Forging a New Civil Rights Movement" (Three Rivers Press, 1994), as well as Eli Claire, Exile and Pride: Disability, Queerness and Liberation (South End Press, 1999), among others.

Returen to Text -

Karl Marx, Capital, volume I: A Critical Analysis of Capitalist Production (New York: New International Publishers, 1967), 699. My argument builds upon Walter Johnson's exquisite reading of said passage (see "The Pedestal and the Veil: Rethinking the Capitalism/Slavery Question" Journal of the Early Republic 24 (Summer 2004): 302. Regarding Johnson's concern for the "provincial" nature of Marx's inquiry concerning capital I would only suggest, by way of friendly amendment, that the formulation he critiques is not merely an oversight. Marx's categories (i.e., labor, commodity, capital) are deployed in a very deliberate way. Having both abstract and concrete dimensions, they refer to the characteristics that objects and activities assume in specific, social contexts as well as the dynamics they exhibit as part of a "global" system whose proponents have characterized it as "universal"/"modern"/"legitimate"/"appropriate"—from the nineteenth century onward—in alleged contrast to prior systems, and to social formations elsewhere, deemed primitive, vernacular, illegitimate. In this sense, Marx's three volumes of Capital might be construed as an ethnography of British industrial capitalism even if the analysis has broader relevance (as do all ethnographies that seek to cultivate the theoretical implications of the specific arguments they develop).

Return to Text -

Michael Ralph, "Thief's Theme," South Atlantic Quarterly 108(8): 541-562.

Return to Text -

Robin Blackburn, Banking on Death, or Investing in Life: The history and future of pensions (London: Verso, 2002).

Return to Text -

W.E.B Dubois, Black Reconstruction in America, 1860-1880 (New York: Free Press, 1999).

Return to Text -

Daniel Rasmussen, American Uprising: The Untold Story of America's Largest Slave Revolt (New York: Harper, 2011).

Return to Text -

Rick Schnurr, "A Layman's Guide to Corporate Life Insurance," (Actuarial Practice Forum, 2008), Archives of the Society of Actuaries.

Return to Text